Yes it’s gouvernement duty on the motoring consumption of these (nothing to do with import duties or VAT treatment)

You can claim VAT back on Avgas expenses if you are paying VAT or your profits from burning it…

Looking into this in more detail, it would appear that a flight leaving the UK should pay VAT on the uploaded fuel, unless the fuel is for “business use”.

One might note that duty drawback is in general a larger amount than the VAT, £0.377 per litre versus say 20% of £1.50 or whatever.

Yes; I am not aware of any HMRC concession allowing an airport to not charge VAT on a flight outbound from the UK. But then I am not a VAT specialist…

I know for a fact that in my business we have to charge VAT to a customer who is collecting something from us even if he tells us he is heading straight for Gatwick and off to somewhere far away.

The only exception, and this will end on 31 Dec 2020, is that we do not charge VAT to an EU customer who has supplied a valid VAT number. Everybody else is charged VAT.

“Business use” is not a factor as far as the supplier is concerned. A VAT registered individual or corporate body can recover VAT paid to the airport, but that’s an unrelated discussion.

The duty drawback scheme is not connected to VAT in any way.

Hmmm. Yes duty and VAT are different regimes. Fuel supplied without UK VAT could cost less than £1 per litre after duty refund. Maybe my company could supply me with avgas as part of its business, with a small markup. This is very murky. Brexit may throw up other issues.

Some airfields in the past have supplied fuel without duty applied if the flight is intended to be overseas.

I have been told by people that they have done this at Lydd and North weald. It was a while ago.

Can’t confirm it was absolutely true.

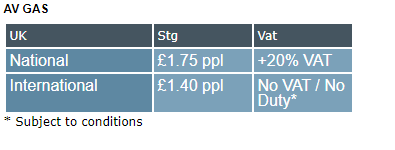

With regards to an airport not charging duty/vat on AVGAS, one airfield I have been to before quite clearly advertises AVGAS prices like this (though I don’t know what the conditions are):

International should be no duty for sure but it should be subject to VAT? the 2nd question is do you pay VAT on base price or VAT on base price without duty, but anyway this is second order effect

Usually duty is added and then VAT on the total. I know that airport…let’s not tell them they should possibly be charging more!

International should be no duty for sure

I think the argument is similar for duty or VAT, in that there are no clear rules.

Currently, across Europe, you can get duty free fuel on production of an AOC. One exception is the UK where the AOC holder has to reclaim the duty afterwards.

The VAT-free fuel option exists at some airports but is a different thing.

In years past, one could get both removed by saying it is a “commercial” flight etc etc and I recall 50p/litre avgas many years ago at LDLO  It was also possible in Spain back then if you wore the full pilot uniform.

It was also possible in Spain back then if you wore the full pilot uniform.