Aart’s post above shows where the real market is.

What do you mean? That post shows the US LSA. In Europe that would be the top end microlight market, it wouldn’t include most of the “bulk”.

boscomantico wrote:

It will anyway only apply to factory new ultralights, not those already in the field. Any decent, factory-built touring ULM costs 100.000€ when equipped and taxes paid. Some of them even 150.000 or 200.000. The uptake will be quite minimal (as it is today), still everybody and his dog gets so excited about this move. A pipedream for most ULM pilots.

I have now heard it through the grapevine that it will in fact be exactly as I assumed. Existing airframes in the field will not be “upgraded” to 600 kgs. All the manufacturers are desparate to sell some new airframes and see this as their ultimate opportunity.

Also, I have heard that the initiative basically failed on a pan-european level. Obviously some countries objected. The result is that the 600kg-limit will not be adopted in all of Europe. Rather, there will be an opt-out by individual countries. And: it seems that this will apply to airspaces, not to aircraft registrations! This means that an ultralight pilot flying internationally with 600 kgs of MTOM will continuously fly in and out of legality; pretty much as is the case today with pilots only holding FAA licenses…

Actually, the last bit I can hardly believe, but let’s wait and see…

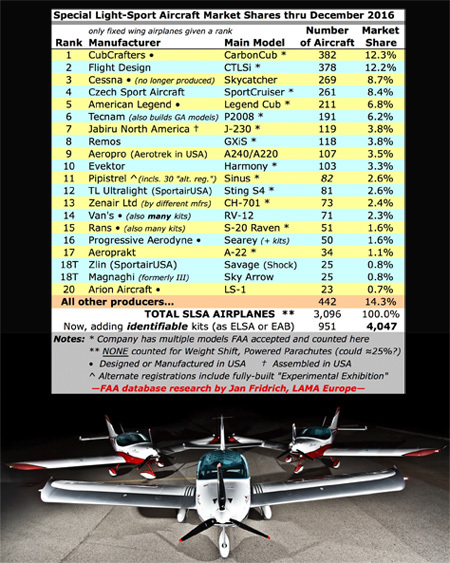

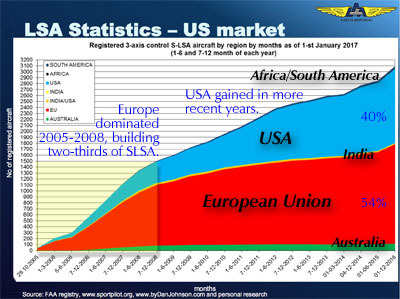

It seems the Americans are much more into statistics than Europe is  In the US, it obviously is a competition of Europe vs US regarding manufacturers of LSA. This makes it kind of fun that the Carbon Cub is loosing out in the last couple of years. They are loosing to Czech Sport Aircraft. Europe doesn’t really have a LSA market though. CS-LSA has been a gigantic flop in Europe, and the reason is of course microlights (essentially the same aircraft, but with zero bureaucracy and hassle). One of the reasons to go up to 600 kg MTOW for microlights.

In the US, it obviously is a competition of Europe vs US regarding manufacturers of LSA. This makes it kind of fun that the Carbon Cub is loosing out in the last couple of years. They are loosing to Czech Sport Aircraft. Europe doesn’t really have a LSA market though. CS-LSA has been a gigantic flop in Europe, and the reason is of course microlights (essentially the same aircraft, but with zero bureaucracy and hassle). One of the reasons to go up to 600 kg MTOW for microlights.

The numbers are the same though. Microlight (or US LSA) outsell traditional certified SEPs by 3 to 1. It’s about the same in Europe and the US. Europe could be much higher also, maybe 4-5 to 1.

In these and other ways, Sport Pilot and Light-Sport Aircraft maintain clear advantages — lower cost, less regulatory burden, the most modern equipment, higher fun-factor — over general aviation. SP/LSA is not going away and one way to be assured of this is the global phenomenon of LSA acceptance in a growing number of countries. Indeed, 2014 statistics show LSA out-delivered GA single engine piston aircraft by more than three to one.

It seems there are 276 active microlights in Norway in 2016. Active meaning planes that has had their yearly “approval” and have actually flown. In total there are much more, at least double, but those others have not flown in 2016, or have not been “approved” that year. The most popular one is the WT-9 Dynamic, a plane costing € 150-200k, but there is only 15 of them, which is 5% of the total. There are also 15 Jabirus btw, a plane costing half that of a WT-9, and 15 Aeroprakts (€50k), and 15 Atecs. There are only 11 Ikarus C42 (the popularity of this aircraft seems to be a very localized German thing  ) All in all, it seems to be a very thorough mix of all kinds of microlight “types” and price ranges.

) All in all, it seems to be a very thorough mix of all kinds of microlight “types” and price ranges.

It seems strange that people actually pay €150-200k for a microlight. But people do, and they do in the same number as with microlights costing 1/4 or less, looking at individual aircraft “types”. On the other hand, it’s not strange at all. These are recreational vehicles, and the only limit is the sky. If you want an Icon A5 to use on your summer house, then you get an Icon A5, if you have the money, or you get nothing. You don’t contemplate about pros and cons of A5 vs 30 year old Cessna on floats costing 1/10 of an A5.

Here’s some data from the US. First table is as of 2006. Does anyone here have such data for Europe?

boscomantico wrote:

The activity is mostly in 8-20 year old, “regular” airframes, whose value is roughly between 20k and 60k

That’s just how things scale. One aircraft sold for €200k is 10 at €20. Obviously you will see fewer 200k airplanes than 20-60k airplanes. Anyway, 95 microlights in Germany isn’t bad. The totals sales of SEP (PPL) was about 150 for the entire Europe last year, 20-30% which went to Germany perhaps. For a manufacturer of low volume, hand made stuff, it is always beneficial to sell fewer high priced items than more low priced items. The development of the market will always go towards higher price and lower volume. New manufacturers always pops up at the bottom though.

Aircraft will never become a mass industry, and will never become a thing for the masses. It’s a very niche, special interest kind of thing. The point with the increase in mass is that those 100-200k aircraft will greatly increase the usefulness. I agree that if this becomes a reality, the number of these aircraft sold will be limited, mostly due to price.

The activity is mostly in 8-20 year old, “regular” airframes, whose value is roughly between 20k and 60k.

Even in Germany, by far the biggest GA nation in Europe, the new registrations of ultralights have been minimal in the last few years. Here’s the detail for 2016

As you can see, everybody except Comco, is in the single digits.

94 aircraft in total. And of these, some will have gone to countries outside Germany (Austria, Switzerland, Italy, etc.).

Any decent, factory-built touring ULM costs 100.000€ when equipped and taxes paid. Some of them even 150.000 or 200.000. The uptake will be quite minimal (as it is today)

I don’t know anything about the UL scene from personal experience, but shows like Aero Friedrichshafen are full of the 100k-200k ones, as if they were really selling. I have always found it hard to believe because you can buy a really good IFR tourer (which obviously also makes an excellent VFR tourer) for that money and have plenty spare for the extra avgas.

The traditional reason for UL – cheap flying – is clearly nonexistent, in that market.

So where is the activity? The “Thruster” type of airframe? I had a close look at one recently, sharing a hangar with it.

How could I be “sure”?

Increasing MTOW on existing airframes would still require the involvement of the manufacturer. And manufacturers have zero interest in that. After 10 years of very low sales numbers, they are seeing this development as their unique chance to get their sales going again.

It will anyway only apply to factory new ultralights, not those already in the field.

Bosco, are you sure of that? There are various UL types flying that have been designed with a higher MTOM than 472 kg (FK14, Bristell etc) if only because they are marketed in the US as an LSA. I think it would be logical that they would be allowed to be flown at MTOM upto that design limit.