If the seller is an EU vat registered entity, and you are an EU private person who is not vat registered then the seller has to charge you vat on the invoice.

Thanks Will!

I’ll report back how it turned out!

Snoopy,

Am I correct in understanding that you have not supplied any VAT number to the seller?

If you have not then the seller should be charging you VAT.

A zero percent rate is a valid rate to charge, but it’s also used for “intra community transactions” which is where one vat registered party sells it to another vat registered party in another country.

So assuming you have not given them a VAT number, then you should ask them on what basis they are charging you 0% VAT. If it turns out that 0% is still the correct rate of VAT on aircraft sales in Denmark, then you are good with that

If for some reason they think you are a VAT registered trader, then you need to correct that misinterpretation before completing the purchase.

It’s also possible that they were unable to reclaim the VAT when they purchased the aircraft and they do not have to charge you any VAT on the sale at all, and they are mistakingly putting that down as 0% rather than not mentioning VAT at all.

I thought VAT was paid once and for all for the first entry in the EU !

If you buy it from an individual, I guess there is no VAT.

If you buy it from a company who operated it, what does happen ?

Posts moved to existing aircraft VAT thread

VAT must be charged by any VAT registered seller (can be a company, or an individual).

It can be zero rated, too (the famous case was Denmark which did this before 2010 for most GA types).

If the buyer presents the seller with a valid EU VAT number and the seller is happy with this (there is a website for validating these) then the seller can zero the VAT.

I think that is about it, in this context.

The #1 thing is to obtain evidence that EU VAT was paid at some point. Read back up this thread for reasons why! If you don’t get this then discount the plane by 20% (or whatever the VAT rate is)  The seller will then tell you to f-off, because there is another mug just around the corner

The seller will then tell you to f-off, because there is another mug just around the corner

This deal smells fishy to me. AFAICT this

Company selling it cannot issue an invoice stating VAT, as then the VAT has to be filed and thereby paid twice, making the plane 25% more expensive.

I have no idea what the following is supposed to mean but was told: „The company cannot be held liable for VAT during a sale, but is liable for the VAT for the aircraft under it‘s ownership of the plane.“

is bollox. I am not an accountant but in 43 years of VAT registered business have never heard of such a thing.

I thought VAT was paid once and for all for the first entry in the EU

There is truth in that but it doesn’t help if it either left the EU for a while at some point, or – I think – passed through the hands of a VAT registered owner.

There is an interesting twist with Socata aircraft – discussed earlier. One which was always in the EU and in non-VAT-registered ownership does not need a Certificate of Free Circulation. However that won’t stop French or Italian police turning you over in demanding one.

Peter wrote:

VAT must be charged by any VAT registered seller (can be a company, or an individual).

If a VAT registered seller:

then they charge VAT only on the margin (difference between buying price and sales price) made on the sale. If the margin is zero (or negative), then that’s a zero amount of VAT.

In principle, if VAT was liquidated by the Danish 0% rate VAT route, and the seller doesn’t make a margin on the sale, then legitimately no VAT is chargeable on this sale. If the seller writes “VAT margin scheme – second hand goods” on the invoice, and the margin system doesn’t apply (or if he makes a margin, he didn’t collect VAT on the margin), he cheated, that’s his responsibility. While the legal principles could/would work in this case, I’m not 100% sure the official at the VAT/customs office will see it that way without a court imposing that. So I’d consider it somewhat risky. I would absolutely require the seller to write on the invoice his VAT number and “VAT margin scheme – second hand goods” (unless you intend to deduct it, the actual amount of VAT is not important for the buyer and doesn’t need to be on the invoice; the seller may (would?) get into trouble for not writing it on the invoice, though). Or alternatively “aircraft VAT status: VAT paid” (or “VAT liquidated and not reclaimed” or “airplane acquired by seller in a VAT exempt transaction under article 136 of the VAT Directive 2006/112/EC of 28 November 2006” or some such).

Peter wrote:

or – I think – passed through the hands of a VAT registered owner.

See above, margin system.

Yes, ok; I now remember that used car dealers use this margin system.

However

bought goods (e.g. an aircraft) from a non-VAT registered person

is not hugely likely because he is paying ~20% more and cannot reclaim it, so why would he?

Basically there are two markets for used planes: no-VAT, and plus-VAT. The former are of interest to Joe Public. The latter are of interest to VAT registered operators. And the prices differ.

I can imagine (but not guarantee) that if VAT was liquidated by the Danish 0% rate VAT route, and the seller doesn’t make a margin on the sale, then legitimately no VAT is chargeable on this sale.

Indeed, but why not just disclose that in plain language?

Also if you were a VAT registered company at the time the Danish route was running, why use that route? If offered you nothing. And the lawyer running it charged a lot of money – around 5-6k for a £200k TB20 (the VAT saved would then have been 15k). I looked at it in 2002, decided it was a ripoff, and went the other way.

If the seller writes “VAT according to margin system” on the invoice, and the margin system doesn’t apply, he cheated, that’s his responsibility.

Then you wonder what else he is cheating you on. The contents of the logbooks? Once a liar, always a liar (well usually)

Someone else, a few pages back, asked the same question as I have:

What happens if you have lost the VAT invoice and the cert of free circ.?

Plane imported many years ago from USA, G registered.

dublinpilot wrote:

Am I correct in understanding that you have not supplied any VAT number to the seller?

You are correct.

dublinpilot wrote:

So assuming you have not given them a VAT number, then you should ask them on what basis they are charging you 0% VAT. If it turns out that 0% is still the correct rate of VAT on aircraft sales in Denmark, then you are good with thatIf for some reason they think you are a VAT registered trader, then you need to correct that misinterpretation before completing the purchase.

It’s also possible that they were unable to reclaim the VAT when they purchased the aircraft and they do not have to charge you any VAT on the sale at all, and they are mistakingly putting that down as 0% rather than not mentioning VAT at all.

I’ll report back how it turned out.

Peter wrote:

Basically there are two markets for used planes: no-VAT, and plus-VAT. The former are of interest to Joe Public. The latter are of interest to VAT registered operators. And the prices differ.

That makes things clearer. Not simpler I’m afraid.

Thanks.

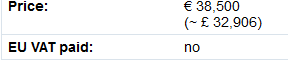

So this :

Means (if the guy writing knows what he does) that VAT must be added for a non-VAT reg buyer.

FYI, the plane is registered to an individual.