That is pretty amazing. Surely it must create scope for a bit of arbitrage? Ship goods from Great Britain to NI then ship them under EU regs from there to the EU?

Yes – as per the other thread link I posted. Without getting into politics, this was a big problem in the negotiations. And there still are problems now although a) I don’t follow the news closely and b) don’t understand it anyway  @dublinpilot or @lionel may be able to explain it better.

@dublinpilot or @lionel may be able to explain it better.

N.I. has been an avenue for various exploits over the years. I vagely recall some gangs shipping millions of nonexistent mobile phones backwards and forwards although this does not mention N.I.

You can be sure that Customs in N.I. will be looking out for obvious signs. Maybe there is a separate agreement re min time in N.I before re-export.

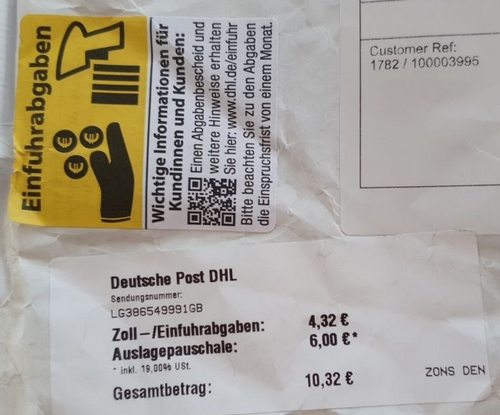

Customs on the mainland are already doing all kinds of weird irritating and (for B2B) illegal stuff e.g.

We get this on roughly 10% of airmail packages. If it was much more I would remove the airmail option from the shop, but that would kill sales of all lower value items. It does not happen with courier shipments, presumably because the Customs people know perfectly aware that somebody at (say) DHL will kick up a stink and report them higher up. They would not dare do it on parcels from the US. That 10% represents really angry customers; that €10.32 one went straight for a paypal refund and sent us a somewhat filthy email

It is possible that in some cases the Customs are doing a classification of recipients as “retail” if it isn’t an obvious business name (e.g. a sole trader) even if the product is obviously not retail. This is something to watch out for. I have just looked at one case and it was like that, but others were clearly businesses. But maybe calling yourself “Johann Müller Systeme” rather than “Johann Müller” might help.

I don’t know if the same issue exists EU → UK. We have the £39-£135 system but I am not sure this is being actually operated; it is obviously unworkable.

Not that amazing – and many companies are doing just that

Which ones?

Without naming names – major UK aviation retailers

So they are paying an extra load of money for shipping…

Peter wrote:

@lionel may be able to explain it better.

No expertise in the specifics of the NI part of the EU-UK agreement.

Peter wrote:

Customs on the mainland are already doing all kinds of weird irritating and (for B2B) illegal stuff e.g.

No, that’s not Customs, and (for the Auslagepauschale) regrettably AFAIK not clearly illegal. That’s DHL German Post, the transporter. They do a customs declaration, prepay the import VAT and charge a service fee for that work. They may have done a sloppy work, they may have done it erroneously, that’s another matter, and a long-standing problem with third countries, that is much much older than Brexit. E.g. packages coming from the USA to Luxembourg clearly labelled “baby clothes”, they will make a “non-baby clothes” customs declaration, prepay the wrong rate of VAT and strong-arm you into reimbursing them that wrong amount. Although I admit the Luxembourg post has been getting better at that lately. If the destination looks like a business name, they actually write/email/phone you to ask for your VAT number, and they don’t prepay the VAT, you self-declare it. (I don’t know if Germany allows for this self-declaration or requires prepayment at import + claim back; it varies between EU Member States.)

Peter wrote:

We get this on roughly 10% of airmail packages. (…) It does not happen with courier shipments, presumably because the Customs people know perfectly aware that somebody at (say) DHL will kick up a stink and report them higher up.

I think that’s just because courier shipments are more expensive, they get better customs relations staff at the courier company than postal parcels. Again, this is not Custom’s doing, Customs just applies the customs declaration done by the transporter, and challenge/check it if they suspect fraud or error. That’s it.

That’s very useful – thanks.

So nothing we can do about it, other than to put a statement on the website that airmail is risky

Hi everyone,

I’m considering purchasing a piper Cherokee aircraft that was registered G when purchased by the current owner back in October ‘21. It was UK VAT paid at that time. The owner then exported it to Netherlands in early ‘23 and paid EU VAT at that time.

See response from UK dealer regarding VAT and re-registering it to G Reg.

“When the owner exported the aircraft he checked with HMRC if he was to bring it back would there be any VAT to pay, and they said he could bring it back as his personal possession, which it is, and there would be no VAT to pay.”

I was under the impression that once an aircraft leaves the G reg, to bring it back / re register it as G, you effectively start again and pay VAT AGAIN because it’s a new import? Is there an exception to that if it’s the same individual re-importing it?

@AndyGreen post moved to existing thread.

In the UK, the reg has no bearing on the VAT treatment.

There is import VAT. That is more complex and depends on how long exported from the EU, and the brexit change no doubt affects it. Somebody will know…

AndyGreen wrote:

I was under the impression that once an aircraft leaves the G reg, to bring it back / re register it as G, you effectively start again and pay VAT AGAIN because it’s a new import? Is there an exception to that if it’s the same individual re-importing it?

I’ve always heard, but haven’t seen the actual regulation, that in EU VAT law, indeed reimport within two years is free of duties and VAT. Insofar as UK VAT law hasn’t changed in this point since Brexit, it would be true for UK also.

I have subsequently been advised that if the same person exports to EU from UK and then re-registers (and hence imports) back into the UK (where VAT has previously been paid) your are UK VAT exempt when you re register. Must be the same person doing the exporting and importing though.

https://www.gov.uk/guidance/pay-less-import-duty-and-vat-when-re-importing-goods-to-the-uk-and-eu

Import for VAT is completely different to import onto an aircraft registry.

My plane went N to F to G then to N and no VAT impact. Also a trust has no VAT impact – in the UK.