Snoopy wrote:

What about an aircraft imported from USA to UK (when it was EU) and G-reg (Vat paid), then subsequently (before 31/12/2020) registered to D-reg and based in EU before 31/12/2020?The vat free document is UK but at a time when the UK was EU.

Any issues requiring measures to remain Vat paid in EU or all good?

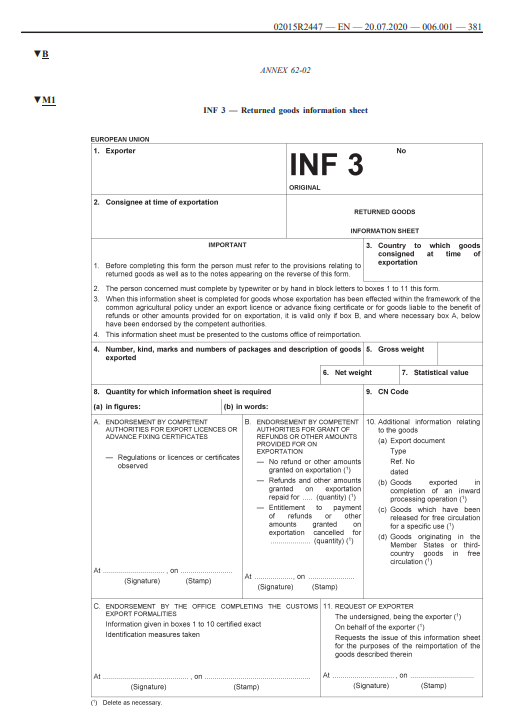

Based on my understanding (I am not a tax or trade expert), that should of course be fine as long as your documentation trail is fine, i.e. you can show the importation and customs clearance documents when the aircraft was imported into the UK. When I asked German customs how to be on the safe side, they said that an INF 3 can be requested and issued upon export from the EU customs territory. INF 3 would prove union goods status and is part of the returned goods relief process whereby you present the aircraft for temporary export (which a flight to a non-EU customs territory would always be) to ensure that it is recognised as a union good upon re-import. So next time you fly to post-Brexit UK or Switzerland (or other non-EU customs territory), you can do that as part of your departure customs formalities. I would send them the documents way in advance so that they get a chance to review them before coming out to the aircraft.

I have also found the overview at https://www.opmas.dk/download/a-quick-overview-over-aircraft-importation/ very useful as it explains the customs code and process in detail from the perspective of a non-EU operator.

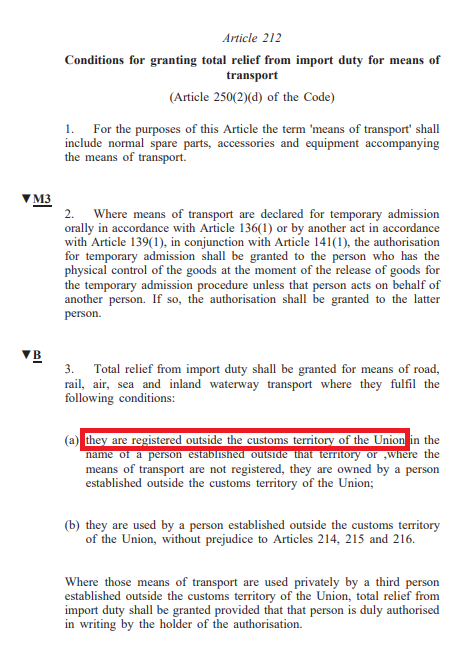

The rather interesting/scary aspect is that according to https://www.opmas.dk/opmas-surveys/temporary-admission-eu-nationality-aircraft-registration-matter/, if an aircraft has an EU27 registration but is no longer a union good post-Brexit (e.g. a D-reg sitting in the UK on 1 Jan 2021) and is flown into the EU27 then it is subject to full importation as it would not be eligible for temporary admission.

That’s pretty scary!

It would also mean that an airliner parked in the UK on the night of 31 Dec 2020 would be liable to VAT when flown out of the UK. So it can’t be simply true as stated.

I find above link local copy confusing. Isn’t “temporary admission” what we do every time we fly abroad?

You quickly get back to the basics of “import VAT paid proof” as in this main thread. There is a big grey area around this, and probably the majority of owners don’t actually have the right document…

Good question is terms of how airliners deal with the problem, which is about EU27 rather than UK, i.e. a Lufthansa aircraft sitting at Heathrow at the end of the year. It would be in the UK under temporary admission then but unless Lufthansa has made special arrangements it will lose EU union goods status (this is codified in the withdrawal agreement).

To answer your question on temporary admission, the answer is no as previous UK-EU27 flights would have been intra-Union for a UK-based operator.

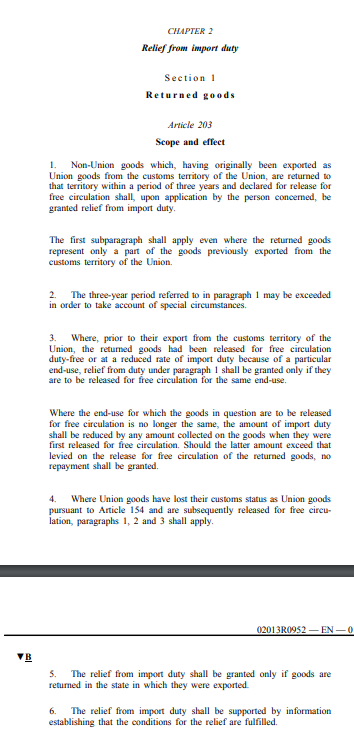

Based on my understanding: Going forward, UK-EU27 flights without union goods status will be imported into EU27 under temporary admission (max 6 months in the EU27) and re-imported to the UK under returned goods relief (max 3 years). And if the aircraft is in the EU27 on 1 January 2021, RGR would apply in both directions as the aircraft would retain “full importation” status. I think this very relevant to aircraft value if there is the possibility of selling an aircraft to someone in the EU27 in the future.

The scary aspect therefore is that e.g. a D-reg sitting in the UK and flown into the EU27 after 1 January 2021 will not be eligible for temporary admission but needs to go down the full importation route.

As far as I can tell, the OPMAS article refers to the following problem and requirement in the UCC delegated act:

What is not clear to me though is whether an aircraft sitting in the UK on 1 Jan 2021 having lost union goods status can regain union goods status if flown back into the EU27 within 3 years from when it had left the EU27. I will enquire that with the German customs office. They seem to be pretty competent as I am dealing with the Frankfurt airport customs office so they should have seen a lot of special cases.

wbardorf wrote:

What is not clear to me though is whether an aircraft sitting in the UK on 1 Jan 2021 having lost union goods status can regain union goods status if flown back into the EU27 within 3 years from when it had left the EU27. I will enquire that with the German customs office.

Essentially my question boils down to why this would not apply also for aircraft having lost union goods status over 1 Jan 2021:

It would also mean that an airliner parked in the UK on the night of 31 Dec 2020 would be liable to VAT when flown out of the UK.

Yes and no.

Yes: it would be liable for EU import VAT at the applicable rate, unless Exempt.

No: airliners and their parts are exempt under Article 148 of the VAT Directive.

@wbardorf wrote:

Just to summarise in terms of what I have gathered from speaking to German customs:

Union goods (i.e. aircraft “free for circulation in the EU”) located within the UK will lose their status on 1 January 2021. This means upon import into the EU (e.g. subsequent sale to someone based in the EU), VAT would be payable.

This can be avoided if the aircraft is moved into the EU and is in the EU on 1 January 2021.

For “EU” above, should we actually write “the Customs territory of the EU”?

Bonus question: does that include Northern Ireland?

Does Lufthansa have any G-reg aircrafts? If not they will only have problems if their D-regs are parked in Heathrow (or Kemble these days) for more than 6months…

they will only have problems if their D-regs are parked in Heathrow (or Kemble these days) for more than 6months…

Fake news. It doesn’t matter where they are parked or for how long There is no Union duty or VAT on CAT aircraft.

There are rumours going around that foreign touring will end because only one airport will be visitable and then you have to fly back to the UK.

That assumes that the temporary import concession (90-180 days, depending on details?) ends, which I can’t believe will happen because that would kill all “private” (non airline) flying into and around the EU… and would be nothing to do with the UK.