It seems like a very generous concession from Germans customs that UK vehicles can retain their “Union Vehicles status” while still being registered in the UK after 2021Jan1 as long as they were based in the EU before that date, I am looking for a similar interpretation from France but nothing yet?

https://www.douane.gouv.fr/sites/default/files/uploads/files/Brexit/Guide-douanier-Preparation-au-Brexit-septembre-2020.pdf

local copy

https://www.douane.gouv.fr/dossier/le-brexit-cest-le-1er-janvier-2021-soyez-prets

It enables Brits to buy a vehicle from the EU27 after 1 Jan 2021, register it in the UK, and drive it to EU27 – is this correct?

It makes practical sense otherwise potential EU27 vehicle sellers (German car manufacturers!!) would lose their sales.

And presumably same for planes. You will be able to buy a D-reg or F-reg etc, put it on G-reg, and fly it to EU27 without getting busted for import duty.

It’s actually in an EU regulation:

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32015R2447

Article 208

Peter wrote:

You will be able to buy a D-reg or F-reg etc, put it on G-reg, and fly it to EU27 without getting busted for import duty.

I read it the other way around, you will be able to have/buy G-reg and put it on F-reg after Jan21 without import duty as long as G-reg was based in EU (not UK) before Jan21

One can always fly G-reg to EU without paying import duty after Jan21 under Temporary Admission but it can’t stay more than 6months limit (and depending on nationality one may need a visa for staying more than 3months)

wbardorf wrote:

It’s actually in an EU regulation:

Thanks for the link, I imagined it’s the same across all countries

depending on nationality

Is there any advantage in me applying for a Czech passport (I can get one)?

In some situations recently discussed it sounded like it would be undesirable to be carrying it when in the EU, however.

Peter wrote:

Is there any advantage in me applying for a Czech passport (I can get one)?

Do you plan to spend more than 90 days within 180 days in the Schengen area?

wbardorf wrote:

I just found this on the website of the German customs authority:

While technically true, and straight application of EU customs law, there are several caveats:

lionel wrote:

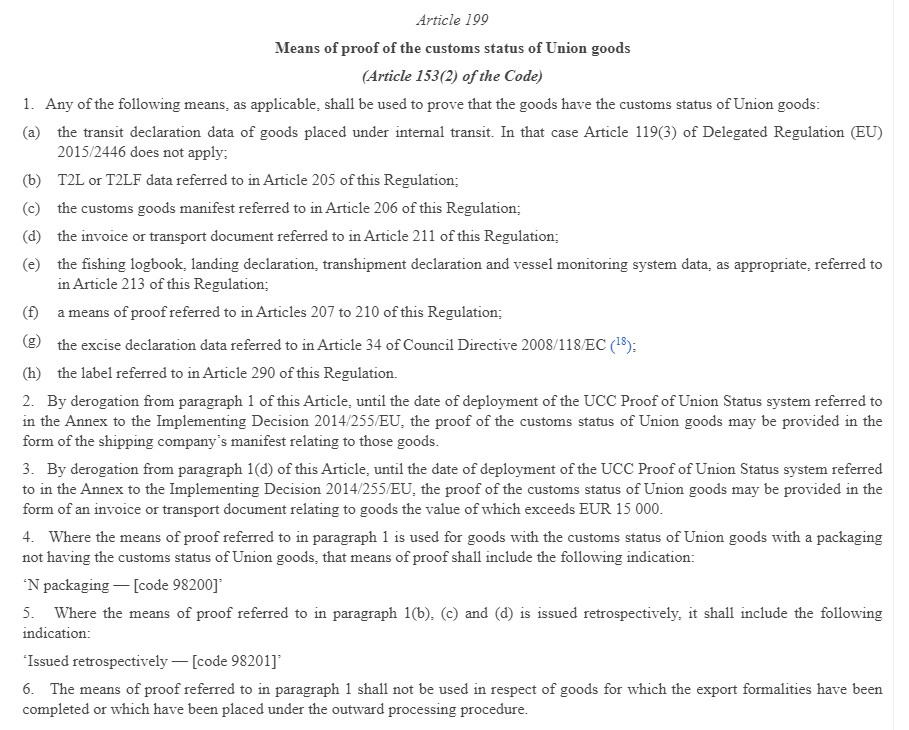

The German customs website alludes to this, but doesn’t very clearly delineate the danger. They say “conclusive evidence such as invoices or transport documents”. These are acceptable proofs under Article 199, section 3 of Commission Implementing Regulation (EU) 2015/2447. Maybe in the case of a car, you’ll have a “transport document” proving the car was loaded/unloaded from a boat, or the train in the under-channel-tunnel. In case of a plane, unless you had the plane crated and shipped from the UK to the EU27 territory, you won’t have any admissible proof.

You are correct. I didn’t mean to imply vehicle = aircraft although it might look like that as I just pasted in the entire answer from the Q&A.

As you say, the regulation is very specific with respect to burden of proof:

And article 208 specifically refers to ‘motorised road vehicles’ and therefore cannot be applied to aircraft.

lionel wrote:

They say “conclusive evidence such as invoices

So keep a stack of fuel and landing fee invoices?

Sebastian_G wrote:

So keep a stack of fuel and landing fee invoices?

They mean “invoice as meant by article 211 of the regulation”, which means invoice of the plane, not of fuel and landing fees. Unless you are trying to prove that the fuel has the status of Union Goods, and not the plane. I don’t see how an invoice predating 01/01/2021 by “more than a little” can prove the plane was in the EU27 at 23:59:59 on 31/12/2020.

Ignore the limit of 15000 EUR, it is waived by article 199 section 3.